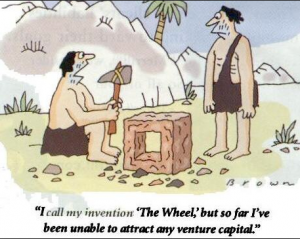

But first here’s What You Need Before Meeting With An Angel Investor:

Angel Investors or Venture Capitalists are just one of many ways to fund your business:

Here are some of the many ways you can fund your business with out a venture capitalist:

- Start by asking your friends and family (folks with liquid assets)

- Ask your professional network

- Apply for a grant

- You can raise funds through the pre-selling of products and services

- Get Affiliate marketers and joint venture partners to sell your products/ services

The launch model or crowd funding is very popular. When done correctly it is a much quicker capital-raising option for: coaches, speakers and authors following the 28 day launch or expert tele-summit model. And yes you increase your odds for success with a joint venture plan.)

JV ATTRAVTION reviews plans. Set up a “Get Your Venture Capital Friendly Business Plan Now!” Phone Strategy Session at. ruth@JVattraction.com.

What kind of plan does a Venture Capitalist want you to have?

A one-page business plan is too brief. Rich Dad Poor Dad, Guy Kawasaki Business 10 page Plan is just the right size and is recommended to present yourbusiness to potential investors. It will also help run your business more effectively. The plan helps you and your potential investors know what market you serve, our operating costs, your unique selling proposition, your projected income and expenses, your competition, your team, your marketing plan, growth projection and exit strategy to sell your business in 5-10 years.

How Do Venture Capitalist make their Investment Decisions?

1. VC invests in unique business ideas that can’t be easily stolen by the competition. (These serial entrepreneurs don’t want to invest $100K+ of their own money if they think someone will open a shop right down the street just like yours.)

2. VC invests in you the owner. It’s based on your likelihood of carrying out your plan and your ability to hit each milestone of profitability. VC prefer to release funds as you hit the next profitable target of running your business. (VC like that you run a successful business or demonstrate extreme discipline in the military and that you will keep your commitments to pay them back with a handsome profit.)

3. VC invest in the passionate business owner(s) with many of the right pieces in place. You are the business owner who needs a specific amount of money for equipment, production space and a modest salary to pay living expenses and grow the business.

4. VC invest in growth businesses that can be infinitely scalable rather than a life style business that is just designed to be run by the owners for a nice 6-7 figure income.

5. VC invest in a business with a clear exist strategy that can likely be sold 5-10 years in the future for millions of dollars.

6. VC invest in a business that is in their field of expertise such as tech businesses, entertainment companies, health and wellness. (Before approaching a VC study what companies VC have funded or where they worked for in the past for clues of where VC companies and investors will invest next.)

7. VC want to work with humble owners who have low starting salaries to cover basic living expenses, equipment. Don’t expect a venture capitalist to take you seriously if you want to make your last corporate salary of $250K+. You are boot strapping your business, making sacrifices and being rewarded through commissions as you grow your business.

8. Venture Capitalist want to know what problem you are solving in the market place and how you can uniquely solve it. They don’t want another “me too” business that can easily be copied or knocked off by the competition.

9. VC want to make a profit and own a large percentage of your company. If they are putting out a lot of bucks they want to be rewarded for their risk. Owning 90% of a company that doesn’t generate any income is far worse than owning 20% of your company that makes millions.

10. When you bring on a VC you are not only attracting big investment dollars you are essentially hiring a business mentor success story that made their fortune starting and running profitable business and coach you to profitable success, saving you beaucoup bucks. As a business owner you need to make sure they are accredited investors and have a profitable track record before you hand over the reins of your business.

No comments yet.